Q: How long has the Art Services team existed at Bank of America?

A: Bank of America has been working with clients to provide solutions for their art and other tangible property for many years. Nearly a decade ago, we launched a formal offering to address the critical needs of collectors, families, foundations and museums throughout the collecting life cycle. This is when I joined from Christie’s to help build the team, grow our art services business and serve our clients. Our vision has consistently been to be the premier service provider for the art world.

Q: To that end, why art? What makes you unique in this space?

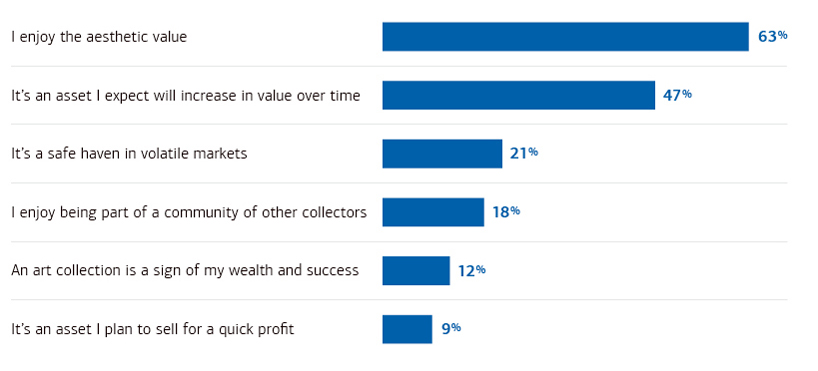

A: First and foremost, we believe in the intrinsic value of art and understand the role that it plays in driving local economies and creating a forum for cultural exchange. Bank of America is one of the leading corporate sponsors of art and culture in the world, and we serve the communities in which we operate by supporting major museum exhibitions, art conservation and cultural sustainability. We also understand the role that art plays in our clients’ lives as one of their highest valued assets both emotionally and financially. However, art is often left unaddressed in the context of a client’s financial life. Addressing this gap is an incredible opportunity for us to serve our clients.

Q: What kind of clients do you work with?

A: It’s quite a range. We work with private collectors, their families and family offices, as well as contemporary artists and art world businesses. Our clients also include private foundations (including artist-endowed foundations), as well as public institutions with art collections — of course, museums, but also hospitals and universities.

Q: How does Art Services work with clients, and when do they typically call your team?

A: Art collectors face key decisions as they move through the collecting life cycle. Starting out, one of the main pain points is access to quality material. After a while, there tends to be a focus on curatorial shifts to reflect evolving tastes and interests, which sometimes involves selling previously acquired art. Clients may also leverage their art collections to fund investment, business or philanthropic opportunities. Later, clients want to think through a plan for the succession of their collection and their collecting legacy. We work with clients in all these contexts, as well as many others.

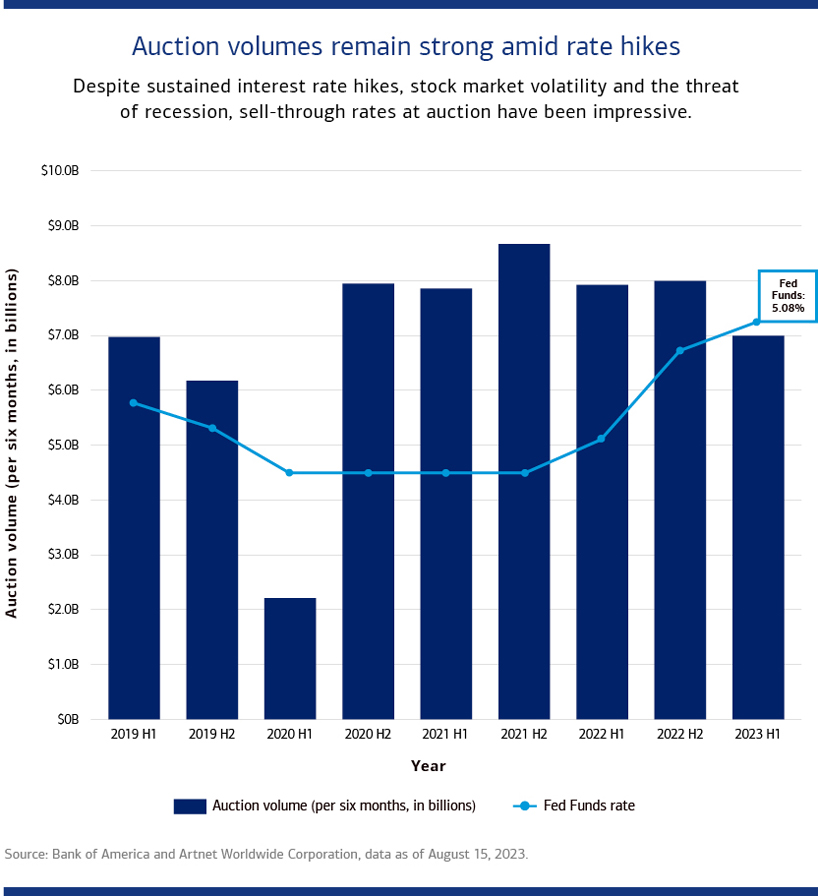

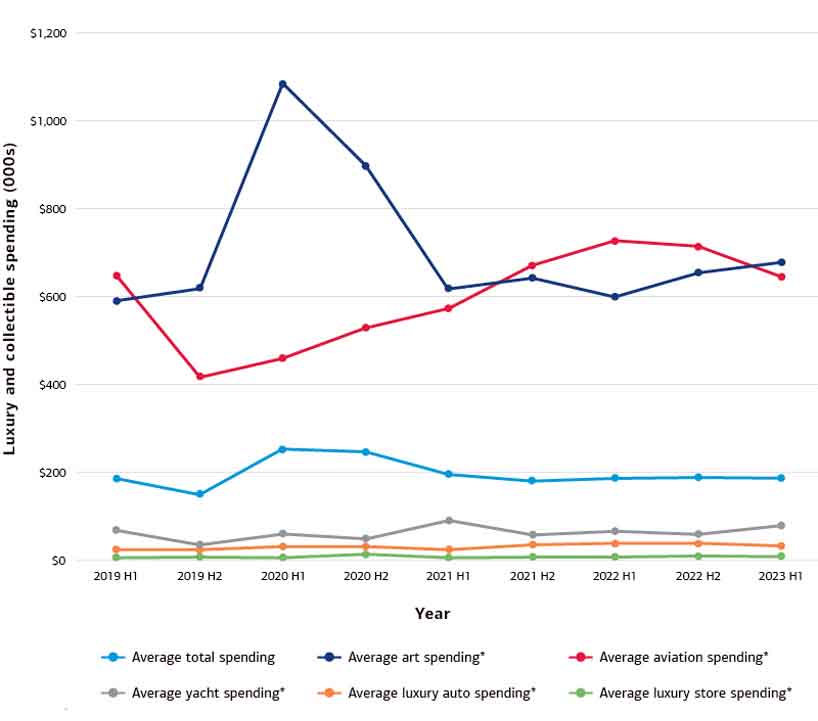

Q: Why do some of your clients take out an art loan, especially now?

A: Regardless of the environment, clients are increasingly turning to their art collections as a strategic source of capital. Since art is an asset that doesn’t generate cash flow and that can be expensive and complicated to sell, many clients prefer to keep their art and borrow against it. Art can be desirable loan collateral because it’s a historically stable asset class over the long term. It’s valued annually (as opposed to mark-to-market prices daily), and clients get to keep it on their walls within the U.S. We see clients use an art loan for a variety of purposes: investing in hedge funds or private equity funds, as a working capital line for their business, to buy more art or to finance charitable donations. We’ve even had clients use art loans to fund the construction of hospitals and museums. Our approach to art lending is highly customized and tailored to the individual client and their need.

Q: You mentioned your team can help clients sell their art. What’s the biggest mistake that collectors make when selling?

A: Selling art is complex: It’s a time-consuming, nuanced process, and it’s not something that collectors do frequently. Sometimes clients sell because of changing tastes, but more often they sell for reasons related to the infamous “D’s”: divorce, death, debt, deaccession and downsizing. Regardless, two things are essential to attain the optimal selling outcome: having clear objectives and a sound strategy for how you will achieve them. We help clients save time and money by guiding them through this process every day, whether they are the builder, inheritor or recipient of an art collection.

Q: What advice would you give those who are just starting their collecting journeys?

A: Be active in the market. See as much art as possible, whether it be at galleries, art fairs or auction previews. Identify what you like, what you can afford and most importantly, what the market is for a particular work. A wise adage to follow is “collect with your eyes, not your ears.” In other words, buy based on the quality of the art you see and your personal connection to it, not what someone tells you is “hot” in the current moment.

Q: After 20 years in the art industry, what’s your long-term outlook on the market?

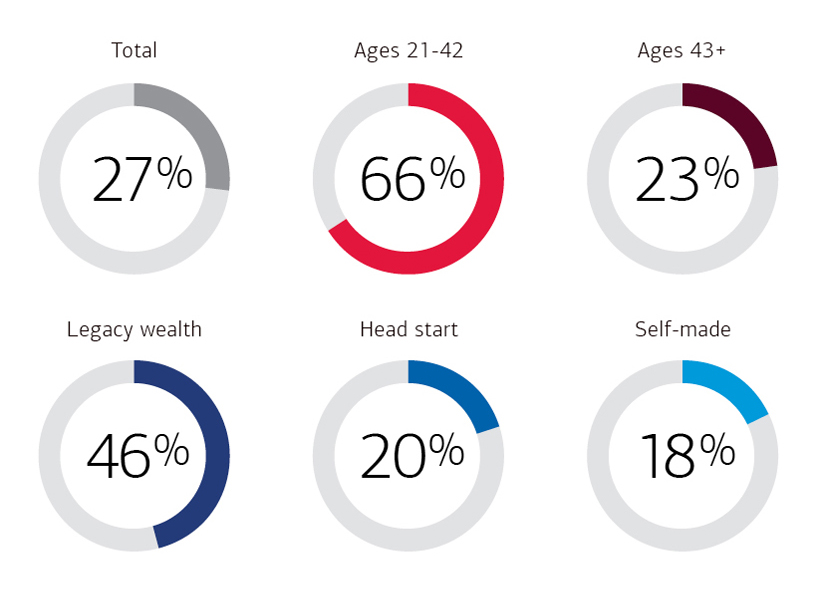

A: People collect art not only because it’s an asset that has historically appreciated over the long term, but also because it’s a reflection of one’s life experiences, values and interests. Art also has a seemingly magical ability to open doors and forge unexpected and valuable connections between individuals. Although what people collect varies greatly across generations, millennials and Gen Z make up a significant and growing portion of the collector base. This bodes well for the market’s long-term prospects.

Q: What’s your favorite part of your job?

A: Seeing some of the greatest art in the world and connecting with clients who share a common passion.

Q: Who is one artist, living or dead, that you’d like to have dinner with?

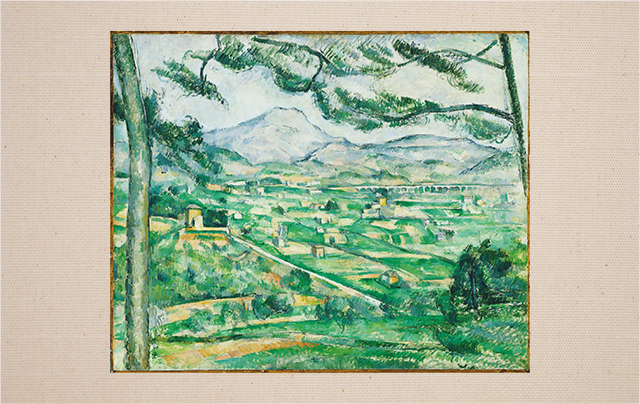

A: I would love to have dinner with Paul Cézanne. His work shaped the course of art history and had tremendous influence on both Henri Matisse and Pablo Picasso, as well as artists after them. I personally feel a connection to his work and its strong grounding in Provence. This year Bank of America funded the conservation of one of Cézanne’s paintings from his Mont Sainte-Victoire series at the Phillips Collection in Washington, D.C., through Bank of America’s Art Conservation Project. You can still see Mont Sainte-Victoire and the surrounding geography today just as Cézanne did from his studio in Provence.

Q: Which is your favorite art fair?

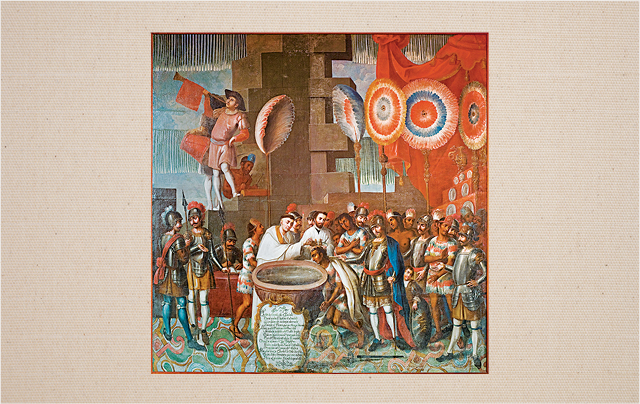

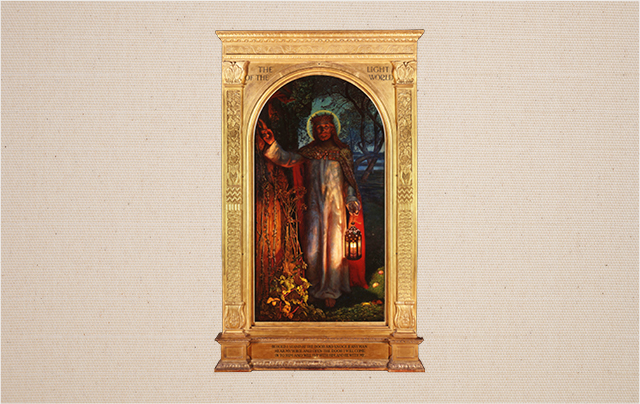

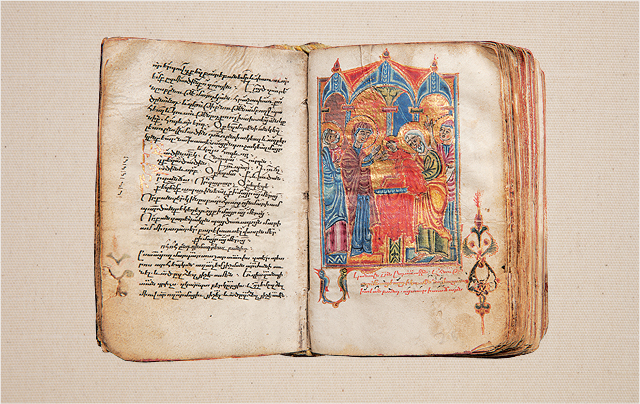

A: As a global advisory board member, my answer is, of course, TEFAF (The European Fine Art Foundation). One of the things I like the most about experiencing a work of art is its ability to serve as a cultural, religious, political, etc. window into a completely different era. TEFAF can offer 7,000 years of art history at just one fair and virtually limitless opportunities to learn and discover new things.