1 Consult your tax advisor, as there are phase-out ranges for IRA contribution deductibility based on modified adjusted gross income (MAGI) ranges that are published annually and correspond to your federal tax filing status (married, filing jointly; married, filing separately; or single) and whether you or your spouse participate in an employer-sponsored retirement plan.

2 For a distribution from a Roth IRA to be federally tax free, it must be qualified. A qualified distribution from your Roth IRA may be made after a five-year waiting period has been satisfied (this period begins January 1 of the tax year of the first contribution or the year of conversion to any Roth IRA) and you (i) are age 59½ or older; (ii) are disabled, or (iii) qualify for a special purpose distribution such as the purchase of a first home (lifetime limit of $10,000). In situations where the original account owner is deceased and the five-year waiting period has been satisfied, distributions to the beneficiary are also considered a qualified distribution If you take a non-qualified distribution of your Roth IRA contributions, any Roth IRA investment returns are subject to regular income taxes, plus a possible 10% additional tax if withdrawn before age 59½, unless an exception applies. A special additional income tax provision applies for converted assets that are not withdrawn in a qualified distribution. If a non-qualified withdrawal is made within five years of the conversion, the earnings withdrawn will be subject to income tax, and the entire withdrawal may be subject to an additional tax unless an exception applies as applicable for conversions. Consult your tax advisor for details.

3 The taxable portion of your withdrawal that is eligible for rollover into an individual retirement account (IRA) or another employer's retirement plan is subject to 20% mandatory federal income tax withholding, unless it is directly rolled over to an IRA or another employer plan. If you have not reached age 59 ½, the taxable portion of your withdrawal is also subject to a 10% additional tax, unless you qualify for an exception. Be sure you understand the tax consequences and your plan's rules for distributions before you initiate a withdrawal. Please note: You should consult your financial/tax advisor with specific questions about your personal situation if you are considering a withdrawal from your plan account.

4 Effective January 1, 2023, the required beginning date for RMDs is age 73. You may defer your first RMD until April 1st in the year after you turn age 73, but then you’d be required to take two distributions in that year. Failure to take all or part of an RMD results in a 50% additional tax applicable to the amount of the RMD not withdrawn. Consult your tax advisor for more information on your personal circumstances.

Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

Bank of America is a marketing name for the Retirement Services business of Bank of America Corporation.

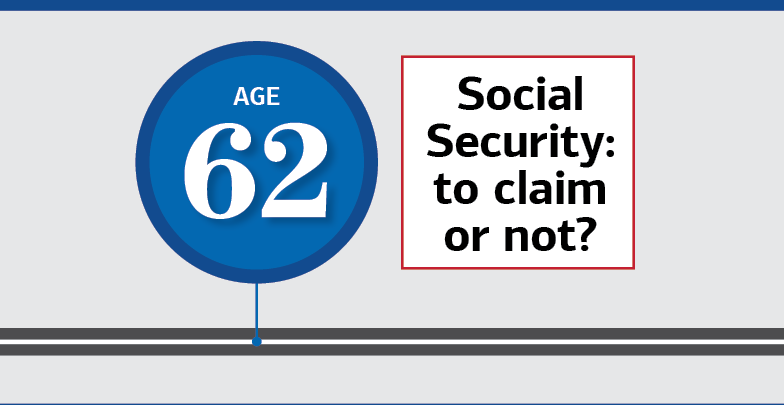

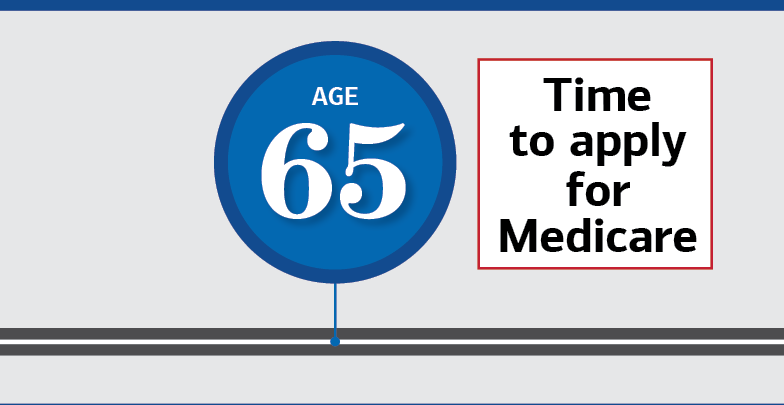

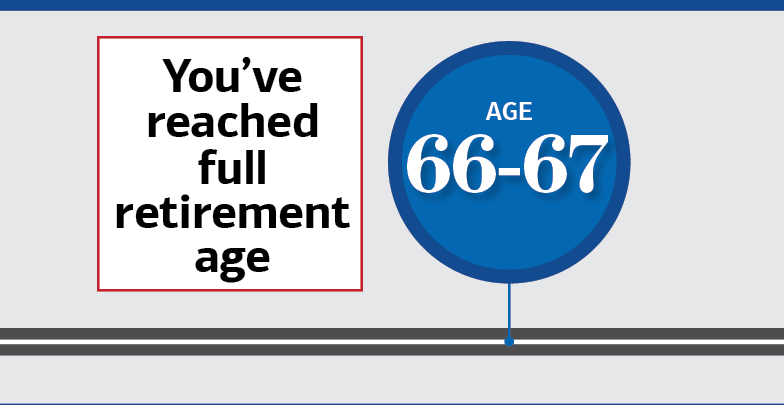

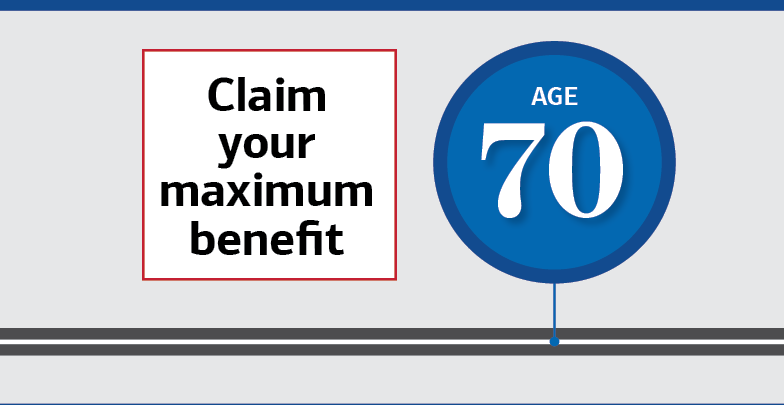

This material should be regarded as educational information on Healthcare and Social Security and is not intended to provide specific advice. If you have questions regarding your particular situation, please contact the Social Security Administration and/or your legal advisors.