Tapping your personal assets

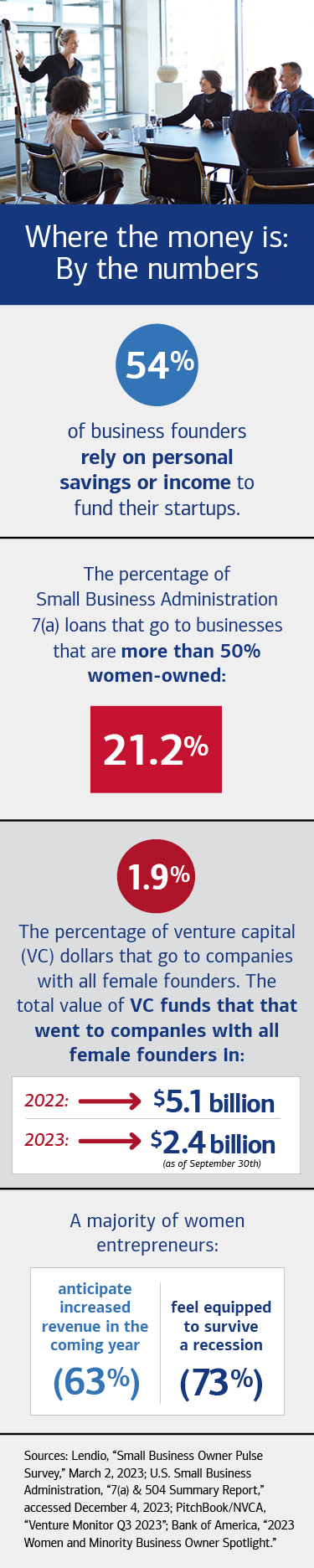

Personal assets and income from another job are the most common sources of initial funding for the majority of entrepreneurs.1 If you’re dipping into savings, keep in mind that you should still try to maintain a healthy emergency fund — ideally a year’s worth of living expenses — because you may not know how soon you will be able to draw a salary from your business, says Merrill Wealth Management Advisor Judith Lee. If you’re near retirement age, tapping your own assets could be especially risky, because the time to rebuild them is shrinking.

More than a third of women small business owners also use credit cards to help cover operating expenses.3 But double-digit interest rates on balances can be an expensive way to fund a startup, notes Lee. Alternately, you could consider leveraging assets you have in a brokerage account as collateral for a loan. “That allows you to have access to the funds on a short-term basis without having to liquidate your investments and losing out on potential earnings growth,” Lee explains. Be sure to talk to your advisor about whether self-funding your business with personal assets will still allow you to meet your other financial goals.

Applying for bank loans

At some point you may want to apply for either a personal loan or a federally backed Small Business Administration (SBA) loan, available through many banks and credit unions. They’re the second biggest source of startup funding, according to Lendio. SBA loans offer lower down payments and longer amortization periods than traditional bank loans. This may lower a small business owner’s monthly payment and may also allow them to retain full ownership of their company.

To get a personal loan from a bank, you’ll usually need a sterling credit record as well as collateral, typically a real estate asset. SBA loans have broader eligibility requirements; businesses typically not approved for traditional loans can sometimes qualify, says Nathalie Molina Niño, author of Leapfrog: The New Revolution for Women Entrepreneurs and co-founder of financial services firm Known. However, you’ll likely still need to have collateral or a down payment, and the approval process can be slow. You’ll also need to start repaying the loan right away, which can be tricky if you’re just starting out.

Another potential source of affordable funding, not to be overlooked, is a community development financial institution (CDFI). Interest rates and fees on CDFI loans are generally comparable to bank loans, but their mission is to serve low-income or underserved people and communities. In addition to credit, CDFIs offer mentoring and useful financial advice. Bank of America, as one example, partners with CDFIs across the U.S. to connect women entrepreneurs to capital. For additional information, explore more useful women’s small business resources.

Accepting funding from friends and family

The third biggest source of initial startup money, according to Lendio, is friends and family members. These sorts of arrangements can work well, but they can sometimes come with strings attached. Be clear about how you might repay such generosity, and be sure to document in writing promises made. Jeni Britton, founder of Jeni’s Splendid Ice Creams, recalls considering taking a $30,000 loan from family friends when she wanted to start her business. “We were told, ‘Don’t take money from anyone right now because if you do, they will own your company. Exhaust every other option first.’” So Britton applied for an SBA loan. Six months later, the loan was approved, and she opened her doors for business. Today, Jeni’s Splendid Ice Creams sells millions of pints each year.

“Being your own boss is a path to both pursuing a passion and gaining more control over your career.”

“Being your own boss is a path to both pursuing a passion and gaining more control over your career.”