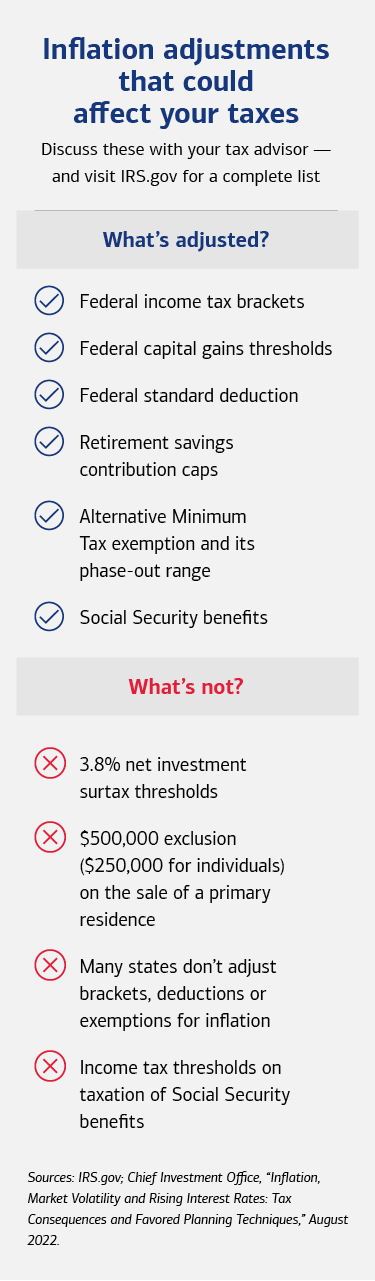

Inflation adjustments that could affect your taxes

Discuss these with your tax advisor — and visit IRS.gov for complete list

What's adjusted?

Federal income tax brackets

Federal capital gains thresholds

Federal standard deduction

Retirement savings contribution caps

Alternative minimum tax exemption and its phase-out range

Social Security benefits

What's not?

3.8% net investment surtax thresholds

$500,000 exclusion ($250,000 for individuals) on the sale of a primary residence

State tax brackets, deductions or exemptions

Income tax thresholds on taxation of Social Security benefits will not be adjusted

Sources: IRS.gov; Chief investment Office, Market Volatility and Rising Interest Rates: tax Consequences and Favored Planning Techniques," August 2022