In addition, the recent environment of higher interest rates and inflation, geopolitical uncertainty, and increased volatility in equity and fixed income markets has favored various Alternative Investment strategies, particularly those that typically display low correlations to traditional asset classes. To the extent that the environment shifts, a sizable opportunity set could unfold across asset classes, as noted below.

Private Credit

Potential Opportunity: Rising short-term interest rates have significantly increased return expectations, with the added benefit of lower durations relative to traditional fixed income strategies. By year end 2022, new private credit transaction yields had risen to low to mid-teens levels. Due to structural factors, direct lenders have become the de facto lenders of choice for many companies and Private Equity sponsors. Interest coverage has declined with rising rates though overall remains at manageable levels, and defaults continue to remain low. Existing Private Credit portfolios, as always, will have to contend with legacy issues; however, fresh pools of capital could find compelling opportunities given the backdrop.

Risk Considerations: Greater-than-expected deterioration of interest coverage; a severe economic recession that creates a spike in default rates, even for private middle market borrowers.

Special Situations and Distressed

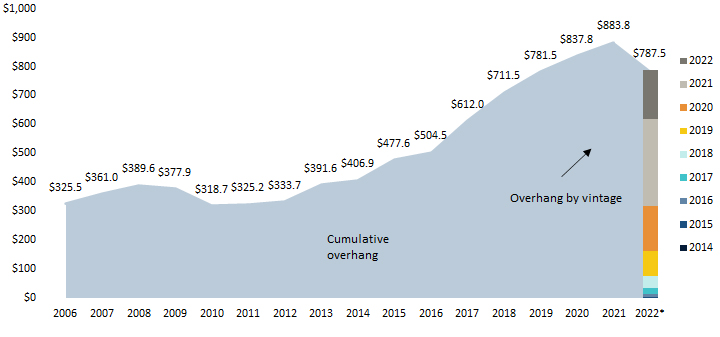

Potential Opportunity: The opportunity set for Special Situations and Distressed was historically sparse in 2021-2022 due to historic fiscal and monetary stimulus. As this government intervention wanes, default rates have begun to rise and are expected to reach long-term averages. In addition, if the credit environment remains challenged for longer than expected (e.g., inflation and rates surprising to the upside or a more severe-than-expected recession), then distressed assets could quickly metastasize. Given that companies largely extended maturities during the forgiving environment of 2021, we expect the opportunity set to unfold at a slower pace than recent cycles.

Risk Considerations: Interest rates revert to a lower-for-longer dynamic; reduced/weakened covenant packages in the syndicated leveraged loan market make it difficult to initiate debt restructurings.

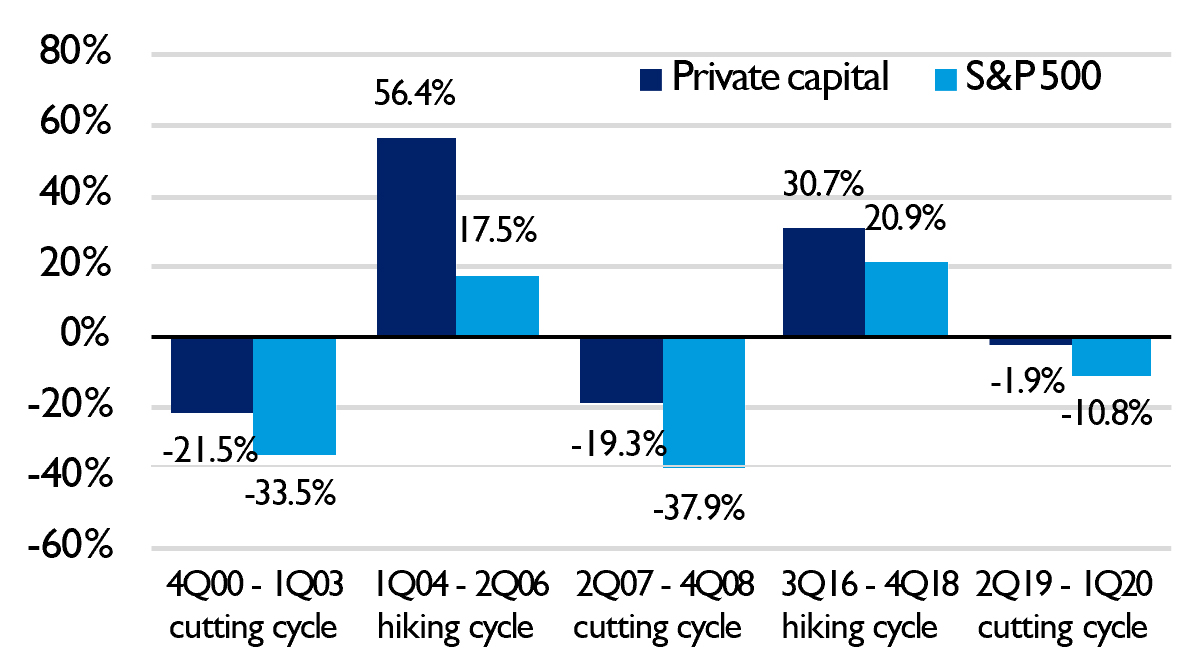

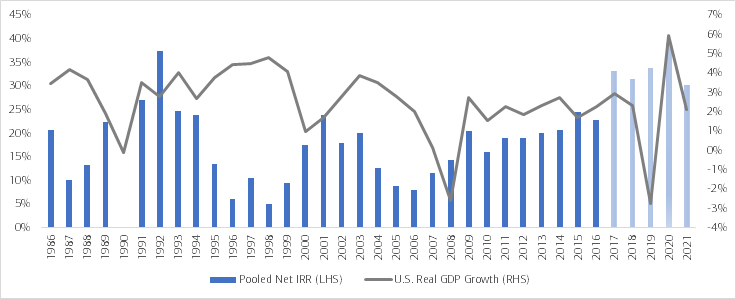

Private Equity

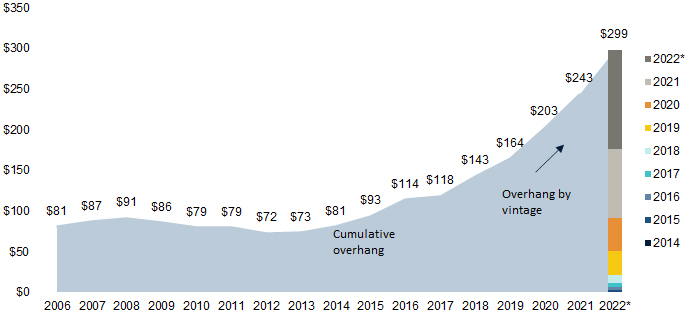

Potential Opportunity: Rising inflation and interest rates presented a challenging environment for Private Equity in 2022—similar to public equities. This led to slowing deal activity and reduced exit opportunities. Despite that, the strategy has had several levers to pull to adjust to the shifting landscape, including focusing on more economically resilient sectors or businesses with hard assets. The rise of Private Credit has also kept open an important source of financing for sponsors. Going forward, with the pace of Fed tightening likely slowing, bond yields declining at the start the year and the valuation gap between public and private markets narrowing, 2023 could see a more favorable backdrop for the strategy. In addition to potentially improved sentiment, structural forces will continue to propel Private Equity to new heights.

Risk Considerations: A slowdown in Private Credit availability to hamper an important source of financing for the strategy; higher financing costs can potentially challenge equity returns and/or require larger equity checks in deals; a severe economic recession could affect existing portfolio companies.

Venture Capital

Potential Opportunity: The pendulum has quickly swung back to favoring limited partners (LP) compared to the frothy environment of 2021, which significantly favored founders. Deals today are expected to be struck with better terms and more compelling entry valuations. In the near term, investors expect an increase in Structured Equity and Venture Debt strategies. Likely unfolding over the course of 2023-2024, the opportunity set for VC vintages during this period of reset for the strategy could be historic, as animal spirits are revived and deal-making resumes.

Risk Considerations: High valuations paid in 2020-2021 could weigh on the market for some time, lengthening the market’s process of adjustment; if interest rates continue to rise that could challenge valuations and keep the initial public offering market closed.

Hedge Funds – Global Macro

Potential Opportunity: Global Macro strategies have benefited throughout this new market paradigm that has characterized the post-pandemic period. The opportunity set is expected to remain fruitful on the back of elevated volatility across asset classes, continued factor reversals, shifts in global monetary policy, and volatile inflation dynamics. Most importantly, Global Macro has historically exhibited low correlations to traditional equity and fixed income strategies while trading in relatively liquid asset classes, thereby providing significant portfolio utility.

Risk Considerations: Reemergence of low-volatility with little to no trends in rates or currencies could diminish return expectations.

Hedge Funds – Equity Hedge

Potential Opportunity: High macro uncertainty and expected dispersion are expected to drive an attractive opportunity set. Equity market neutral strategies in particular may be best positioned in this environment. From a portfolio construction standpoint, an allocation to these funds sourced from traditional long-only investments can help reduce portfolio beta and potentially increase alpha, thus helping to provide differentiated equity risk.

Risk Considerations: Significant rise in equity correlation; lower single-stock dispersion; exogenous shocks to the financial system.

Selecting The Right Alternative Investments

As with all investment decisions, the right investment depends on a range of factors, including your risk tolerance, time horizon, tax sensitivity and liquidity needs. The Chief Investment Office recommends an allocation to Alternative Investments of 20%-30% for many investors. It also encourages clients to understand how each individual investment supports an investor’s overall goals and to take a diversified approach when adding Alternative Investments to a traditional portfolio approach.

Talk to your advisor about how allocating to alternatives may make sense for your overall investment strategy.