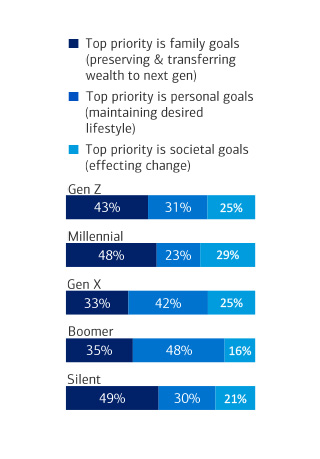

Bar graph depicting % of Gen Z, Millennial, Gen X, Boomer and Silent generations in three priority categories. Dark blue represents “Top priority is family goals (preserving & transferring wealth to next gen); Medium blue represents “Top priority is personal goals (maintaining desired lifestyle)” and light blue represents “Top priority is societal goals (effecting changes)”. Results for Gen Z: 43% top priority is family goals (preserving & transferring wealth is next gen); 31% Top priority is personal goals (maintaining desired lifestyle); 25% Top priority is societal goals (effecting change). Results for Millennial 48% top priority is family goals (preserving & transferring wealth is next gen); 23% Top priority is personal goals (maintaining desired lifestyle); 29% Top priority is societal goals (effecting change). Results for Gen X 33% top priority is family goals (preserving & transferring wealth is next gen); 42% Top priority is personal goals (maintaining desired lifestyle); 25% Top priority is societal goals (effecting change). Boomer results 35% top priority is family goals (preserving & transferring wealth is next gen); 48% Top priority is personal goals (maintaining desired lifestyle); 16% Top priority is societal goals (effecting change). Silent is 49% top priority is family goals (preserving & transferring wealth is next gen); 30% Top priority is personal goals (maintaining desired lifestyle); 21% Top priority is societal goals (effecting change). Overall this chart is showing that Gen Z and millennials are more likely to prioritize transferring their wealth. [detail available in the Study of Wealthy Americans - https://ustrustaem.fs.ml.com/content/dam/ust/articles/pdf/2022-BofaA-Private-Bank-Study-of-Wealthy-Americans.pdf )

A profile of wealth in America

This research was conducted in June 2022 by Bank of America Private Bank in partnership with research firm Escalent. The survey findings reflect the responses of 1,052 people aged 21 or older, with household investable assets over $3 million. It was designed to be a statistically representative sample of the population in the U.S. that meets these two criteria.

1 Cerulli Associates. (2022). U.S. High Net Worth and Ultra-High-Net-Worth Markets 2021.

2 Lustbader, Rachel. ‘Caring.com’s 2023 Wills Survey Finds That 1 in 4 Americans See a Greater Need for an Estate Plan Due to Inflation.’ Caring.com, 2023, https://www.caring.com/caregivers/estate-planning/wills-survey/; ‘Demand for Estate Planning Increases As More Millennials Become Caregivers.’ Ettinger Law Firm, 2022, https://www.trustlaw.com/blog/demand-for-estate-planning-increases-as-more-millennials-become-caregivers/ ; Hodder, Esq., Catherine. ‘Covid-19 Is Making Young Adults Think About Estate Planning.’ Findlaw, 2022, https://www.findlaw.com/legalblogs/estate-planning/covid-19-is-making-young-adults-think-about-estate-planning/

3 Top 25 Industry Ranking – Personal Trust Assets Under Management (FDIC call reports, as of December 31, 2022).