Widowhood: The loss couples rarely plan for — and should

No one is ever ready emotionally for the death of a spouse. But you can prepare financially for the decision-making and reduced income you may someday face.

ONE PERFECT FALL MORNING IN 2012, Erin was waiting for her husband to return from dropping off their twins at preschool. He never came home — at the age of 42, he suffered a massive heart attack in the parking lot of the preschool. By the time Erin got to the hospital, he had passed away. At the age of 41, Erin found herself a widow with four children under the age of 8.

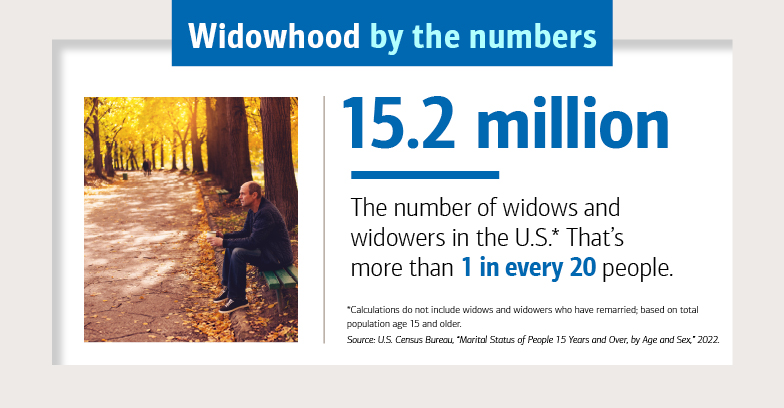

Losing her husband at such a young age places Erin in the minority — only about 3% of the 15 million people who are widowed in the U.S. are under 451 — but the shock and grief she felt are universal emotions that all widows and widowers experience. On top of her grief, Erin soon found herself dealing with such issues as filing for life insurance and her husband’s Social Security benefits, removing her husband’s name from their joint accounts and worrying about how she would plan for her children’s financial future — alone. Recalls Erin, “Beyond meeting our day-to-day needs, I was most worried that our children wouldn’t have the life that my husband and I had planned for them.”

While older widows and widowers may not be burdened with similar concerns about their children’s financial future, they often find themselves dealing with another serious consideration: Will they be able to afford the care they might one day need?” says Cynthia Hutchins, director of Financial Gerontology at Bank of America. This can be particularly worrisome for those who’ve gone through a prolonged and expensive period of caregiving for their lost loved one — a situation many widows find themselves in.

While everyone experiences this profoundly difficult — but, for most couples, inevitable — life event differently, planning for the process can help alleviate the stress.

A widow’s financial journey

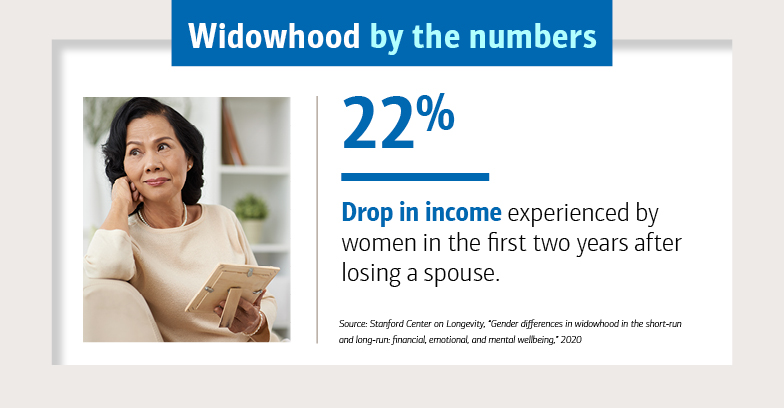

The financial burdens that come with the loss of a partner are immense and immediate. Erin’s position as assistant headmaster for institutional advancement at a private boarding school gave her an advantage that few widows have. “I was fortunate that as part of my compensation, the boarding school offered housing,” Erin says.

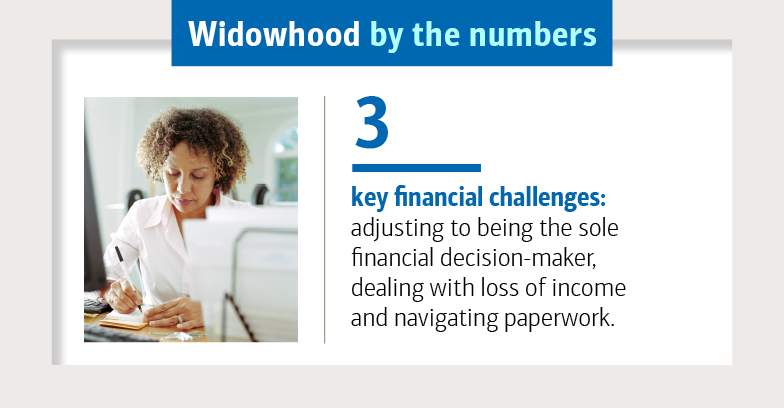

In addition to the financial demands, critical paperwork and decision-making begin their steady creep right away. That’s when help from a knowledgeable professional can be invaluable.

“Older widows and widowers often find themselves dealing with another serious consideration: Will they be able to afford the care they might one day need?”

For instance, in consulting with her Merrill Private Wealth Advisor, Richard Salvino, as well as Matthew Saland of her advisory team, Erin learned that decisions she made about managing the benefit from her husband’s life insurance policy could affect her children’s eligibility for future financial educational aid — a major need for her with four young children.

Solo decision-making can be even more daunting when you have dependents at home. Research suggests that any financial decision that isn’t time-sensitive should be put off until you’re feeling less emotionally vulnerable.

“The most difficult thing is the constant worry,” notes Erin, pictured with her children below. “That started early on, and it continues all these years later.” Over time, Erin’s advisor helped her work through issues involving her return to full-time work and saving for retirement. “We looked at all sorts of expenses and what decisions would need to be made in order to achieve the goals I had for the kids: what’s realistic, what isn’t, what would need to take place to achieve my family’s goals.”

Erin recalls that the day-to-day financial pressures were so great that she told her advisor she might cut back on what she was setting aside for retirement. “And he advised me not to — that retirement needed to be one of my first priorities so I could take care of myself in the future,” she says.

Erin recalls that the day-to-day financial pressures were so great that she told her advisor she might cut back on what she was setting aside for retirement. “And he advised me not to — that retirement needed to be one of my first priorities so I could take care of myself in the future,” she says.

Salvino made Erin’s long-term financial health a focus. “Given that she was young, continuing to contribute to her retirement plan was important,” he says. “She had many years ahead of her to save and let the compounding effect of wealth work in her favor. You can always borrow for your children’s education, but you can’t borrow for your retirement.”

Finding the courage — and financial confidence — to go on alone

Amid all the pain and difficulty that losing a spouse brings, there is also healing, as widows and widowers can find courage that they never knew they had.

“They’re forced to jump into complex financial matters from the start of their journey and adjust to making financial decisions alone,” says Lisa Margeson, managing director, Retirement Research & Insights, Bank of America. Those changes could lead to greater financial confidence, which can help sustain you through a difficult time. Erin’s private wealth team helped her stay true to her and her husband’s core priorities, she says. “They helped me see myself financially in a bigger picture than I could see myself. It’s been those discussions that have helped me the most.”

Choose your advisor in a more personalized way

All our advisors are committed to putting your needs and priorities first. Find some who match your personal preferences too.